US oil company Chevron believes that implementing a global carbon pricing system is the key incentive for driving low-carbon investments and scaling up energy transition technologies. Barbara Harrison, Chevron New Energies vice president, emphasized this perspective during the BloombergNEF Summit 2023 in London.

According to Harrison, establishing a carbon price benchmark would provide consistency in regulations and clear cost elements for companies. This is especially in the context of rising emissions where, she argued, such consistency is vital for the industry.

The Ultimate Incentive to Spur Demand

The second-largest oil company in the U.S. is a proponent of a global carbon price mechanism. Harrison stated that “Chevron supports a global price on carbon.” She further noted that:

“We think the ultimate demand side incentive that you can put in place is to have a price on carbon that is [established] to the point where markets are linked and becomes globally consistent.”

The idea of taxing carbon emissions through a ‘cap-and-trade’ system is widely supported in some major markets like Europe and the UK. But it remains a political controversy in others, notably the United States.

The ‘Patchwork’ Issue

The contrasting approaches to carbon pricing in developed markets have led to a “patchwork” of different rulebooks, Harrison added. This fragmentation discourages investments.

This matter is concerning given the fact that the world badly needs huge amounts of capital flowing into initiatives that help combat climate change. Differences in climate policies and incentives can deter significant investments at the scale needed.

With that said, a global system for pricing carbon emissions would provide companies with a clear understanding of the costs associated with emissions and reducing them. This level of carbon price policy and consistency is crucial when attracting large investments from various partnerships.

For Chevron, carbon pricing should be the primary policy tool to achieve carbon emissions reduction targets. The oil major made it clear in its climate change report that like oil price forecasts, information and analysis of carbon price forecasts are important to their net zero strategies as stated in its climate change report.

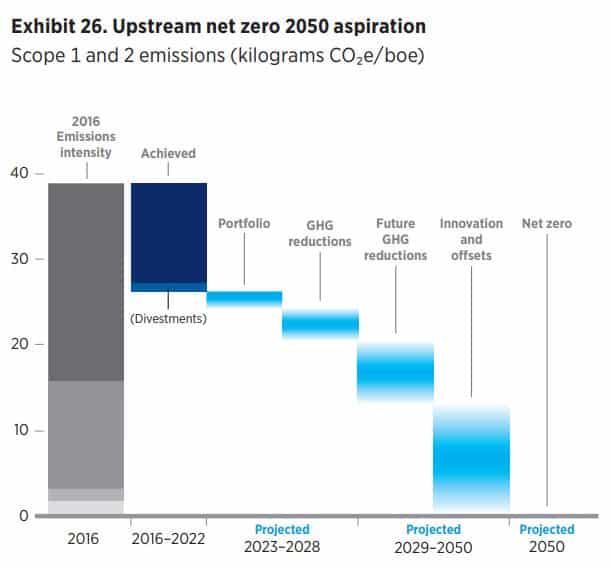

Chevron’s 2050 Net Zero Aspiration

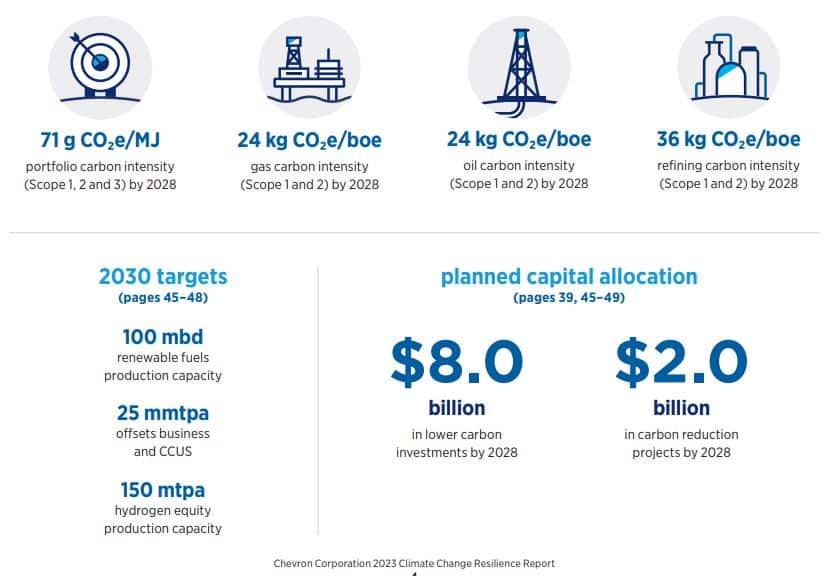

Chevron aims to reach net zero upstream emissions by 2050 by lowering the carbon intensity of their operations. This involves four key business areas – portfolio, gas, oil, and refining, each with its own target as seen below.

- The emission intensity metrics are equity based, meaning they reflect the share of emissions from assets the firm owns and operates as well as their non-operated joint ventures.

The US-based oil giant has tripled its investment to $10 billion into low-carbon business initiatives. The interim goal is to slash its greenhouse gas emissions from oil and gas production by 35% by 2028.

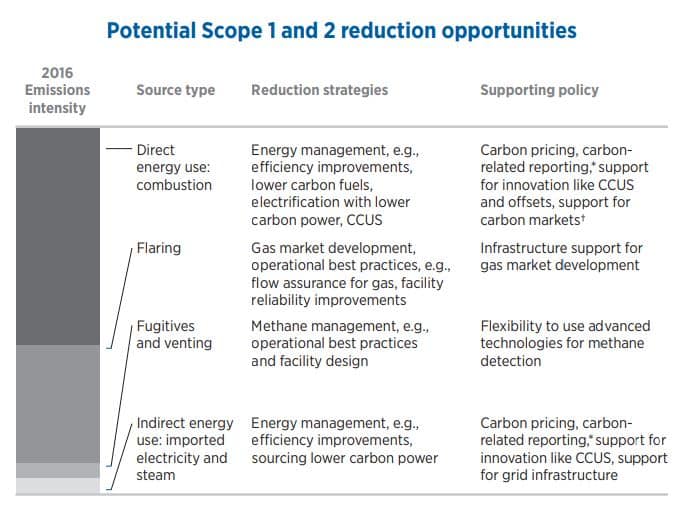

Most of Chevron’s direct emissions (Scope 1) and indirect emissions from purchased energy (Scope 2) are related to energy use. They can be reduced by effective energy management such as efficiency improvements or switching to low-carbon fuel.

The big oil firm manages to lower its total operating emissions from 2018 through to 2022. For instance, it slashed emissions down to 53 million tonnes CO₂e in 2022 from 68 Mt CO₂e in 2018. The same emission source was down in 2021 to 57 Mt CO₂e.

This year, the oil company claimed to have 120+ GHG abatement projects with a budget of over $350 million. Last year, they made progress on 90 projects and had finished 13 of them. They expect to fund about $2 billion on related projects by 2028.

Once all these projects come into fruition, they can deliver approximately 4 million tonnes of emissions reductions annually.

Opportunities for CO2 Emission Reductions

The big oil firm seeks to reduce carbon footprint in three major areas of energy management:

- Methane management, includes venting, fugitives, and flaring reductions,

- CCUS – carbon capture, utilization, and storage, and

- Carbon offsets

Offsetting is done through natural or technological removals, such as nature-based solutions and CCUS, also known as CCS. Again, the oil company emphasizes that these carbon reduction measures can leverage support by policies on carbon pricing.

Chevron has retired or cashed in almost 6 million carbon credits from major voluntary carbon registries between 2020 and 2022. About 50% of its carbon offset programs are linked to hydroelectric dams, mostly found in Columbia.

For its other emission reductions opportunities, Chevron sees potential in the following pathway toward its net zero aspiration.

Chevron’s support for a global carbon pricing mechanism underscores the need for consistency in climate regulations to drive low-carbon investments. With a commitment to reach net zero emissions by 2050, Chevron is tripling low-carbon investments while significantly reducing emissions. Their call for a global carbon price represents a crucial step towards accelerating the energy transition and fueling emissions reductions.